By Srinivas Chowdary Sunkara // petrobazaar // 16th March, 2022.

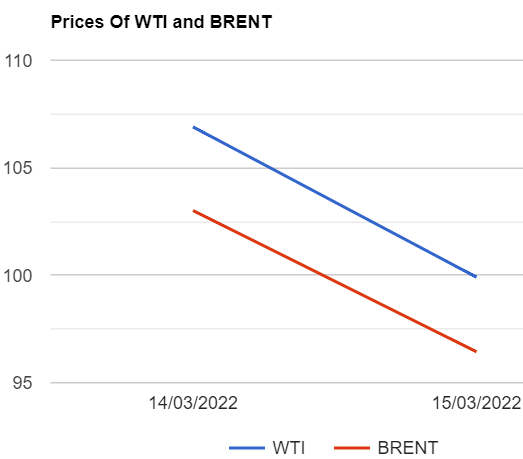

Brent oil futures for May delivery plummeted $6.99 or 6.54 pct to settle at $99.91 a barrel on London based ICE futures Europe exchange. WTI oil futures for April delivery fell $6.57 or 6.38% to settle at $96.44 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices settled 55.4 Yuan down to 628.1Yuan/bbl while MCX crude oil front month futures prices tumbled Rs.420 or 5.39 pct to Rs.7377 a barrel yesterday. Brent premium over WTI narrowed down to $3.47 a barrel during the session.

The world crude oil price index curves continued to slid after both the benchmarks prices slumped to below $100 for the first time since late Feb. Trading has been extremely volatile after Russia started invading Ukraine. Russia suggestion to revive the Iran nuclear deal, U.S fed is preparing to raise interest rate that support dollar in turn will press dollar denominated oil pressed oil prices. China saw a steep jump in Covid cases that may deter oil demand in near futures are the other factor that kept check on oil prices. Turning to weekly report, API showed U.S crude stocks to rise by 3.8 Mb while gasoline stocks fell by 3.8 Mb where as distillates stocks rose by 888,000 barrels during the week ended March 11th. EIA will confirm numbers today. Technical indicators are seen to reach over bought territory since December. They had been in overbought conditions during early March. Asian markets opened in bullish mood today.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com