By Srinivas Chowdary Sunkara // petrobazaar // 16th March, 2021.

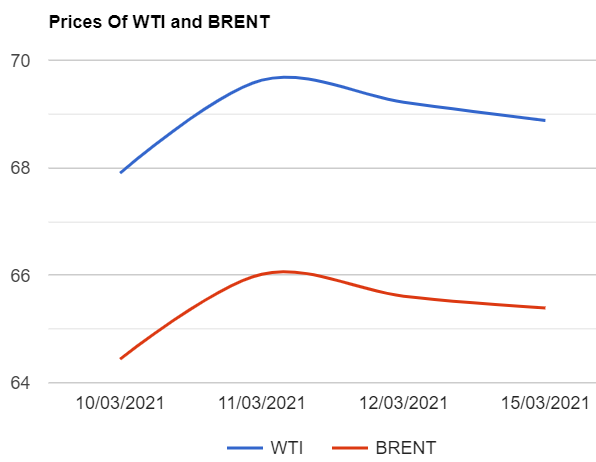

Brent oil prices for May delivery inched down 34 cents or 0.49% to settle at $68.88 a barrel on London based ICE futures Europe exchange. In U.S, WTI oil April futures prices edged down 22 cents or 0.34% to close at $65.39 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices rose 4.7 Yuan at 428.1 Yuan/bbl while MCX crude oil current month futures prices went down Rs.51 to close at Rs.4745 a barrel yesterday. Brent traded at a premium of $3.49 a barrel over WTI during the session.

The world crude oil price index curves moved slightly down yesterday on inflation worries. Accelerating China's economic recovery, Supplier's pact to rein in production , Decreasing virus cases and massive U.S stimulus package are the other bullish factors, that are supporting oil complex. Any dips in oil prices remain swallow and short-lived since the futures spreads remain in backwardation. On the other hand, Hedge fund mangers and other money managers were small buyers reversing the previous two week's selling, as the outlook for oil prices becomes more uncertain after four-month strong rally. As per John Kemp, Bullish long positions outnumber bearish short ones, Indicating positioning is already somewhat lopsided and increasing the probability of a short-term reversal. API numbers are awaited later today. Asian markets opened in red today, extending yesterday's losses.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com