By Srinivas Chowdary Sunkara // petrobazaar // 16th Feb, 2022.

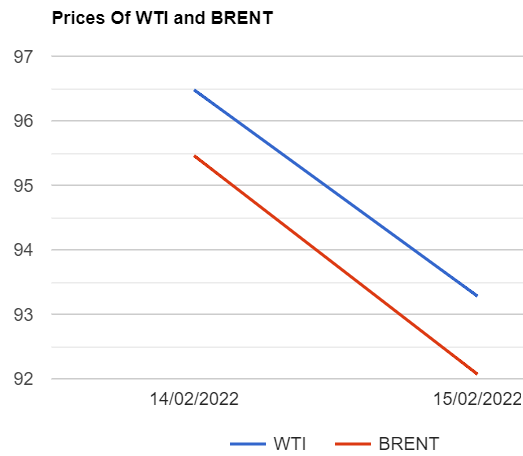

Brent oil April futures prices slid $3.2 or 3.32 pct to close at $93.28 on London based ICE futures Europe exchange. WTI oil March futures prices slumped $3.39 or 3.55% to settle at $92.07 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices inched up 0.9Yuans to 577.7Yuan/bbl while MCX front month futures prices settled down Rs.168 or 2.37 pct at Rs.6926 a barrel yesterday. Brent premium over WTI widened $1.21 a barrel during the session.

The world crude oil price index curves turned down on de-escalation of Russia-Ukraine tensions yesterday. Both the benchmark prices retreated from seven-years high after Russia withdrawn some of their troops to their bases following exercises near Ukraine. On Monday, prices skyrocketed on depleting stocks across OECD countries on growing demand amid geo-political tensions. Brent six-month calendar spread, Which is closely correlated with stocks levels has surged into a backwardation of more than $8 per barrel this week. Portfolio managers are still bullish over petroleum futures and options on growing demand for oil after consumer and business spending remains focused on manufactured items. Turning to weekly data, API reportedly showed a decline in U.S crude stocks by 1.1Mb while gasoline and distillates stocks were fell by 923,000 barrels and 546,000 barrels during the last week. EIA will confirm numbers later today. Consensus is on draws. Asian markets opened in green zone, taking back some of yesterday's losses. Markets are closely watching U.S- Iran nuclear talks and expecting to be remain in bullish mood today. Weekly numbers may spur some volatility. Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com