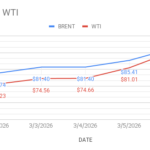

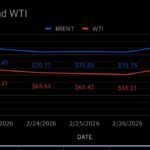

Crude prices diving on Thursday morning session during Asian hrs, Paring early sessions gains. Benchmarks gained 1.5 pct last night. Bearish weekly nos and boost in Venezuela’s oil exports are the fundamental trade irritants. Trump statement of ‘cooling down tensions in Iran’ sagged down oil prices that mounted Selling pressure. Turning to monthly nos, OPEC report maintained supply-demand balance during 2026, Contrasting other reports of major supply glut.

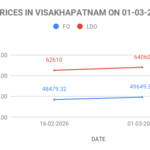

Fuel oil markets demonstrated upside momentum in Asia at SG trading window. VLSFO spot differentials edged higher over firmer demand outlook in Jan from Bunker markets. Market structure flipping from contango to mild backwardation. HSFO held in discounts as prompt supplies remained plentiful. FO LDO prices likely to see moderate upside in India.