By Srinivas Chowdary Sunkara // petrobazaar // 15th February, 2019.

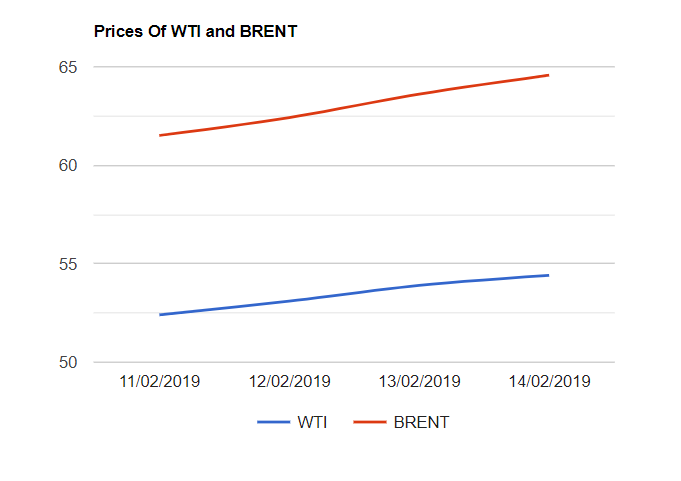

Brent rose 96 cents or 1.51 pct to settle at $64.57 and WTI prices inched up 51 cents or 0.95 % to close at $54.41 a barrel last night. Both the futures advanced for the third day in a row, Heading towards weekly gains. Oil complex gained around 20 pct since the beginning of the year. A positive sentiment was spilled over oil futures from the financial markets on the backdrop of building investor optimism that the United States and China could resolve the trade irritants. A surprise increase in China's export numbers and oil imports added fuel to the bullish sentiment yesterday.

Market is getting tight over OPEC+ supply cuts along with the healthy growth in oil demand in the fourth quarter overshadowed the dislocation in the physical markets. Coming to weekly numbers, EIA reported that U.S crude and products stocks rose last week. The steep rise in U.S shale oil availability led to piling up of crude and product stocks. With reference to the latest IEA report, The prices of physical barrels of light, sweet crude that yield more gasoline came under pressure while the heavier, sour graded crude that yield high value of distillates benefited from sanctions on Iran and Venezuela which drived Saudi to look into fast growing Asian markets. Asian markets are opened up today. Good day.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com