By Srinivas Chowdary Sunkara // petrobazaar // 15th Dec, 2022.

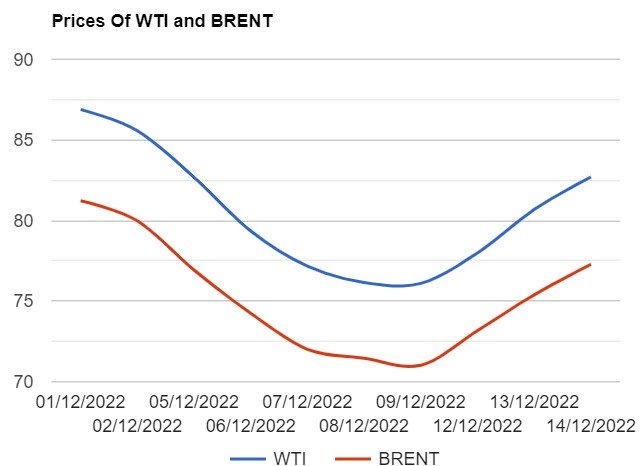

Brent oil Feb futures prices surged $2.02 or 2.5 pct to close at $82.7 a barrel on London based ICE futures Europe exchange while WTI oil futures prices for Jan delivery climbed $1.89 or 2.51 pct to settle at $77.28 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices rose 2 Yuan to 529.4 Yuan/bbl where as MCX crude oil front month futures prices ballooned up by Rs.126 to close at Rs.6401 a barrel yesterday. Brent premium over WTI widened to $5.42 a barrel during the session.

The world crude oil price index curves continued to demonstrate upside momentum on supply concerns over U.S-Canadian pipeline leakage that ships 620,000 bpd of Canadian crude to the United States. Turning to monthly reports, OPEC said that it expects oil demand to grow by 2.25 Mbpd over next year to 101.8Mbpd with a potential upside from China. IEA sees rebound in oil demand in 2023 to 1.7 Mbpd, that supported oil complex.

Putting some light on weekly reports, EIA reported that U.S crude stocks are piled up by 10.2Mbpd, against drawings. Gasoline and distillates stocks are also built up by 4.5 Mbpd and 1.4 Mbpd respectively during the week. On the other hand, Federal reserve raised interest rates by 50 basis points, A downshift from the 75 basis point hikes it had delivered at its last four policy meetings. Brent contract has returned to a backwardated market structure where by front-month barrels are trading higher than later deliveries which indicates that supply worries are subsiding. Today, Asian markets are trading in bearish mood taking back some of the gains in the previous session.

Good day to all

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com