By Srinivas Chowdary Sunkara // petrobazaar // 14th Dec, 2022.

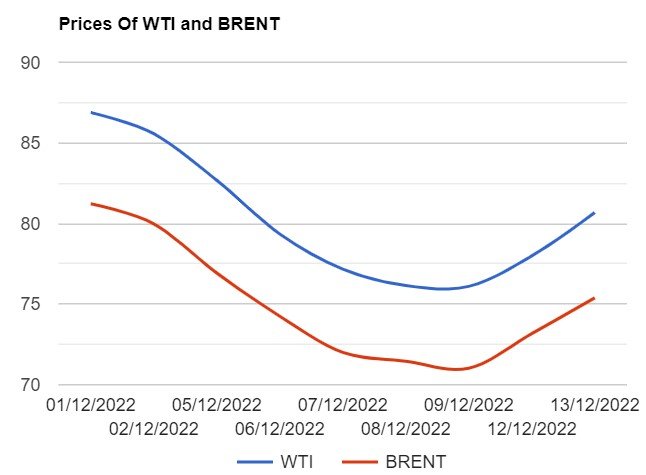

Brent oil Feb futures prices surged $2.69 or 3.45 pct a barrel on London based ICE futures Europe exchange while WTI crude oil Jan futures prices rose $2.22 or 3.03% a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices went up 20.2 Yuan to 527.4 Yuan/ bbl where as MCX crude oil front month futures traded Rs.190 or 3.12 pct up to Rs.6275 a barrel yesterday. Brent traded over WTI at a premium of $5.29 a barrel during the session.

The world crude oil price index curves continued to move upside on weaker dollar and supply concerns. Both the benchmarks traded up at highest price after Nov 4th as the markets bought up purchasing riskier assets followed by less than expected inflation by CPI data. On the supply side, Supply disruption due to massive leakage in U.S-Canadian pipe line that may draw SPR. On the other hand, Dollar index plunged after U.S consumer price index reinforcing expectations that the Federal Reserve will slow the pace of its interest rate increase on Wednesday. Turning to weekly data, API estimated that U.S crude, Gasoline and distillates stocks are piled up by 7.819Mbpd , 877000 and 3.9Mbpd respectively during the last week. Cushing stocks are jumped by 640000 during the week. Today, Asian markets are trading in red since the API numbers showed bullish numbers. EIA confirmations are awaited.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com