By Srinivas Chowdary Sunkara // petrobazaar // 14th January, 2020.

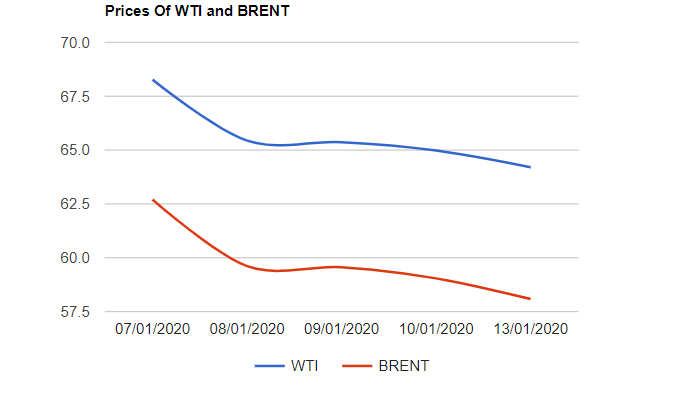

Brent futures prices for March settlement lost 78 cents to $64.2 while WTI oil futures prices for Feb delivery shrank 96 cents at $58.08 a barrel last night. In Shanghai, crude oil main contract futures prices dropped 2.2 Yuan or 0.46% to 476.9 Yuan/barrel while MCX crude futures settled down Rs.70 at Rs.4132 yesterday. Brent oil traded at a premium of $6.12 over WTI during the session.

The world crude benchmark price indexes further sagged down yesterday following ease of middle east tensions, Participants have had a time to focus on fundamentals. Investors shifted their focus on sense of over supply and lackluster seasonal demand after looking at last week's bearish inventory data. Analysts are in the opinion that U.S refinery margins sapped crude prices particularly winter demand for hating oil disappointed suppliers. Turning to trade deal, U.S-China trade agreement is scheduled to be signed on Wednesday and is largely discounted in the price level which may not provide strong boost to price level. On the data side, API predictions are awaited later tonight. As per Reuters survey, U.S crude stocks likely to decrease while product stocks are estimated to rise. Today morning, Asian markets are opened in green. I guess bears will continue to celebrate till we see the weekly numbers.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com