By Srinivas Chowdary Sunkara // petrobazaar // 13th Sep, 2022.

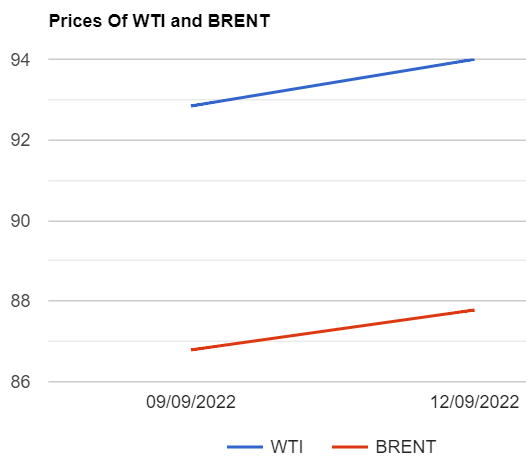

Brent oil futures for Nov delivery rose $1.16 or 1.25 pct to settle at $94 a barrel on London based ICE futures Europe exchange where as WTI oil Oct futures prices surged 99 cents or 1.14 pct to close at $87.78 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices remained unchanged while MCX crude oil front month futures prices changed up a little with Rs.45 or 0.65% to Rs.6968 a barrel yesterday. Brent traded at a premium of $6.22 a barrel over WTI during the session.

The world crude oil price index curves moved up yesterday shaking off demand worries as the supply concerns mount heading into winter. U.S energy department reported that U.S emergency stocks fell 8.4 Mb to 434.1 Mb in the week ended Sep 9th, Its lowest since Oct, 1984. Biden administration weighing the need for further SPR releases to tackle high oil prices. On the supply side, Global oil supply is expected to tighten further when a European Union embargo on Russian oil takes effect on Dec 5. On the bearish side, Strong dollar, expected contract in China's demand and rising U.S production will continue to weigh on oil complex. Turning to technicals, Hedge funds and other money managers sold the equivalent of 40 Mb in the six most important petroleum futures and options in the week to Sep 6th. Worsening outlook for manufacturing across North America, Europe and Asia as well as the persistent cycle of lockdowns in China are now more than offsetting concerns about the low level of distillate stocks. Today, Asian markets opened in red, drawing some of yesterday's gains. API weekly numbers followed by EIA confirmations are due.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com