By Srinivas Chowdary Sunkara // petrobazaar // 12th August, 2021.

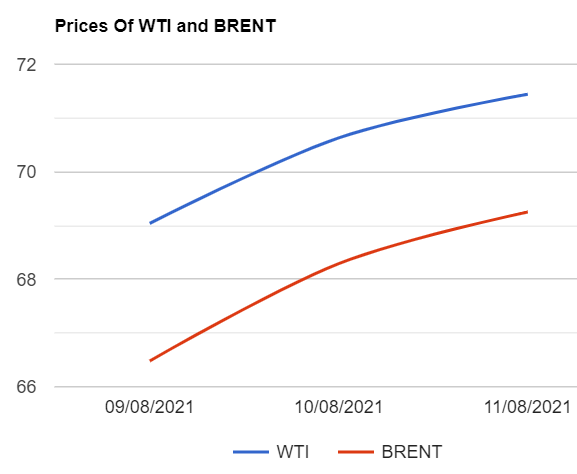

Brent oil futures prices for Oct delivery rose 81 cents or 1.15 pct to settle at $71.44 a barrel on London based ICE futures Europe exchange. U.S crude oil benchmark, WTI futures to be delivered in Sep closed 96 cents higher at $69.25 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices advanced 8.1 Yuan to 434.6Yuan/bbl while MCX crude oil front month futures prices ticked Rs.32 up to Rs.5141 a barrel yesterday. Brent premium over WTI narrowed down to $2.19 a barrel during the session.

The world crude oil price index curves sloped up after showing a downside momentum in the early trade followed by the White house urging U.S producers to increase production. Later on prices recovered and turned back to upside after Biden plea to OPEC+ countries to boost production in the long term and further calling on The Federal Trade Commission to monitor the U.S gasoline market to address any illegal conduct that might be contributing to price increases for consumers at the pump.

Turning to weekly data, U.S crude oil and gasoline stocks were drawn by 0.4Mbpd and 1.4Mbpd respectively while distillates stocks were built up by 1.8Mbpd during the last week as per EIA data. Although crude production numbers were increase, Dip in imports and ramp up in exports along with boost in refinery throughput and percent utilisation might have contributed to crude stock draws. Slid in gasoline stocks indicated the improved demand growth from travel movement. U.S stock numbers shifted the spot light away from OPEC opening spigot. Today, Asian markets opened in green and I hope markets will continue with prevailed positive sentiment. Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com