By Srinivas Chowdary Sunkara // petrobazaar // 12th June, 2020.

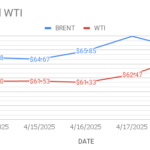

Brent oil futures for August delivery dived $3.18 or 7.62 pct to settle at $38.55 a barrel on London based ICE Futures Europe exchange. WTI oil futures to be delivered in June slumped $3.26 or 8.23 pct to close at $36.34 a barrel on NYMEX. In Shanghai, crude oil main contract futures prices dropped by 6.7 Yuan or 2.13% to 308.2 Yuan/barrel. MCX crude oil June futures prices dropped Rs.178 to Rs.2786 a barrel last night. WTI traded at a discount of $2.21 over Brent during the session.

The world crude oil benchmark price indexes slumped last night, erasing early week's strong gains on EIA report of U.S stocks build last week. Investor worries over downward pressure followed news that U.S producers were restarting production and some Middle East producers, notably Iraq, will continue to producer more than their OPEC+ quota calls for. WHO stated earlier this week that new coronovirus cases have reached their highest ever level, pointing to key regions, such as the Americas and Southeast Asian that suggests prospectus of second wave of pandemic which will dent oil demand also weighed on price complex. Although deep product cuts pact supported oil rally last week, Market sentiment was driven by bearish factors across the market.

Turning to EIA weekly report, U.S petroleum inventories climbed largely to a record 2.1 billion barrels due to large volumes of import from Saudi that was loaded at the height of the Saudi-Russian volume war launched in March. As per the report, U.S commercial crude oil inventories were build up by 5.7 Mb and another 2 Million added temporarily to the SPR. Gasoline and distillates were increased by 0.9Mb and 1.6 Mb respectively. Analysts John Kemp is in the opinion that the current crude stocks is likely to fade once the current wave of tanker finish discharging, with inventories stabilizing or even falling, as the flow of crude from the Kingdom slows. Asian markets are opened with gap down today with extended losses from yesterday.

Good day to all and happy week end.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com