By Srinivas Chowdary Sunkara // petrobazaar // 12th Dec 2019.

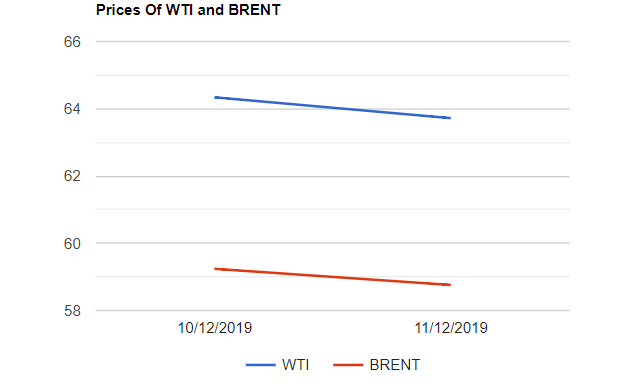

Brent oil futures prices for February delivery lost 62 cents to $63.72 and WTI oil futures to be delivered in January fell 48 cents to $58.76 a barrel last night. In Shanghai, crude oil main contract futures were down by 0.7 Yuan or 0.15% at 465.4 Yuan/barrel while MCX crude oil futures settled Rs.39 down at Rs.4156 yesterday. Brent premium over WTI narrowed down to $4.96 during the session.

The world crude oil indices dropped almost 1% following a surprise massive build in U.S crude inventories. Expected fresh U.S tariffs on Chinese goods fueled the bearish mood in the market. Prevailing trade war worries clouded the demand outlook which signs the gloomy economic outlook. Turning to weekly data, U.S government data painted a bearish picture by reporting 0.8 Mb build in commercial crude oil inventories while gasoline and distillates stocks increased by 5.4 Mb and 4.1 Mb respectively. U.S crude output stood at 12.8 Mbpd after slipping 100 Kbpd during the last last week. Coming to monthly oil reports, OPEC released a more bullish outlook for 2020, forecasting demand for its crude to average 29.58Mbpd next year, less than the group's Nov output. OPEC expectation of small deficit suggests a tighter market than previously thought.

Today morning, Oil futures opened in a positive mood. Bullish monthly numbers may support oil markets today. IEA report is awaited. Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com