By Srinivas Chowdary Sunkara // petrobazaar // 12th Nov, 2018.

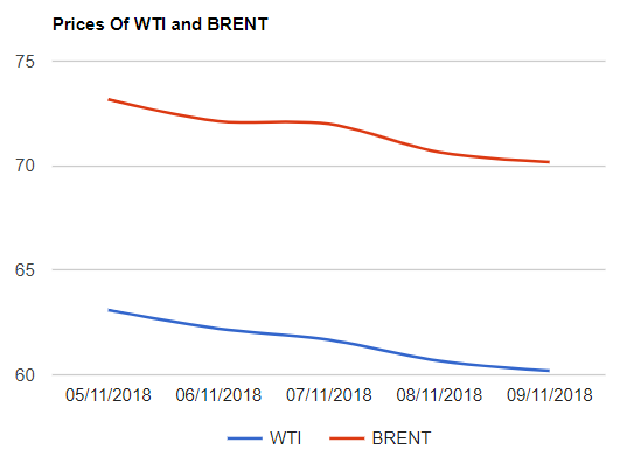

On Friday, Brent closed down by 47 cents or 0.67 pct to $70.18 where as WTI futures settled down by 48 cents or 0.79 % to close at $60.19 a barrel. Last week, Bears dragged the oil markets into their territory deeply as no technical support could stop the falling prices closer to $70. U.S sanctioning waivers to 8 major consumers of Iran oil and bearish stocks reports are to be attributed as the reasons for a weekly loss of around 4 pct for the 5th straight week.

Brent prices moved into 'contango', a phenomenon where the spot price is lower than that of futures contract. U.S drillers added another 12 rigs into operations last week. Saudi announced to cut 0.5 Mbpd in Dec and discussing with OPEC and non-OPEC allies to trim the production up to 1Mbpd. Oil markets are expected to rebound to move up. Rig numbers may cap the gains. Asian markets are opened in positive territory.

Disclaimer: Views and opinions expressed here are for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com