By Srinivas Chowdary Sunkara // petrobazaar // 12th Feb 2020.

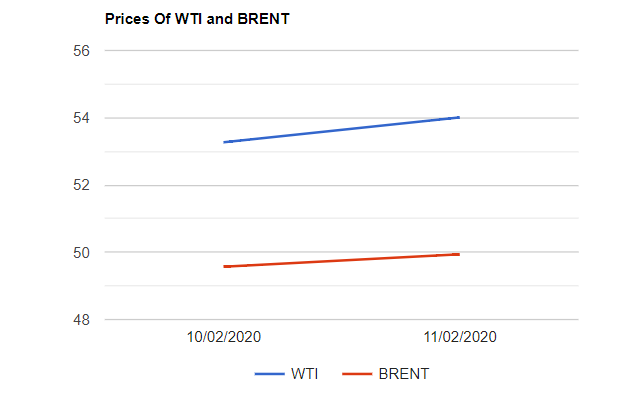

Brent futures prices to be delivered in April rose 74 cents or 1.39% to $54.01 on the London based ICE Futures Europe exchange while WTI March futures prices gained 37 cents or 0.75% to settle at $49.94 on NYMEX. In Shanghai, Crude oil main contract futures dropped by 1.3 Yuan or 0.33% to 397.8 Yuan/barrel where as MCX current month crude futures closed Rs.39 up at Rs.3580 yesterday. Brent traded at a premium $4.07 over WTI during the session.

The world crude oil price indexes turned into slight upward evolution after a report that the number of new virus cases slowed in China, Eased concerns over pinching fuel demand. I think speculator group is looking beyond 'virus'. While turning back with new positions, Investors remain skeptical that non-containment of virus will rumble for another crash. On the other hand, Crude complex was propped up by a climb in global equity markets. Turning to weekly data, API reported late Tuesday that U.S crude and gasoline stocks were piled up by 6Mbpd and 1.1Mbpd for the week ended Feb 7. Distillates stocks were reported to be drawn during the week. EIA will confirm the numbers later today. Consensus is on build in crude and gasoline stocks by 2.3Mbpd and 700Kbpd respectively last week.

Today morning Oil futures prices continued yesterday's gains during the Asian hours and it does not demonstrate any firm trend so far. EIA numbers may hint some clues to the market. Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com