By Srinivas Chowdary Sunkara // petrobazaar // 11th Feb 2020.

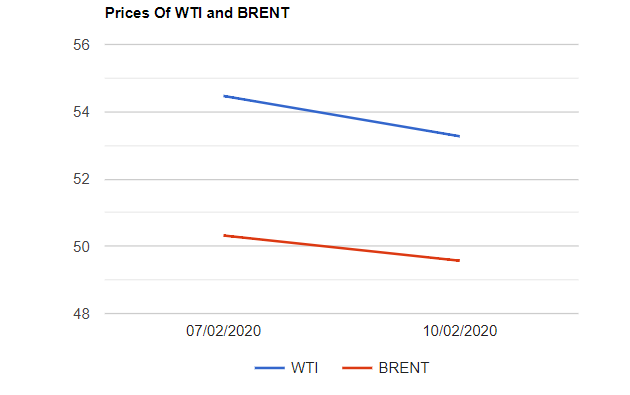

Brent oil futures to be delivered in April dived $1.2 or 2.2% to $53.27 and WTI oil futures prices for March delivery slipped 75 cents or 1.49% to $49.57 a barrel last night. In Shanghai, Crude oil main contract futures dropped by 4.8 Yuan or 1.19% to 399.9 Yuan/barrel while MCX crude futures in India settled Rs.76 down at Rs.3541 yesterday. Brent premium over WTI fell to its lowest level since August 2019.

The world crude oil futures price indexes tumbled to its lowest levels since Dec, 2018 yesterday. The energy complex continued to experience downward pressure on mounting signs of dent in crude demand on the outbreak of corona virus in China. Traders awaited to see if Russia would join to further rein in supplies from producer's club. Both the benchmarks are trading in oversold territory for last 13-14 days, longest bearish streak since Nov, 2018. On the supply side, Lack of enthusiasm from Russians for deeper cuts, proposed by the technical committee of OPEC+, under mined the efforts of OPEC to prop up prices. Oil traders are in the opinion that the proposed 600Kbpd cuts are not sufficient to tighten the market as the Chinese refineries would cut refining throughput by about 940Kbpd this month. Turning to weekly data, API numbers are due later today.

Today morning, Oil markets opened in green during Asian hours and it does not demonstrate any firm trend so far. Weekly numbers may spur some volatility. Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com