By Srinivas Chowdary Sunkara // petrobazaar // 10th Dec, 2021.

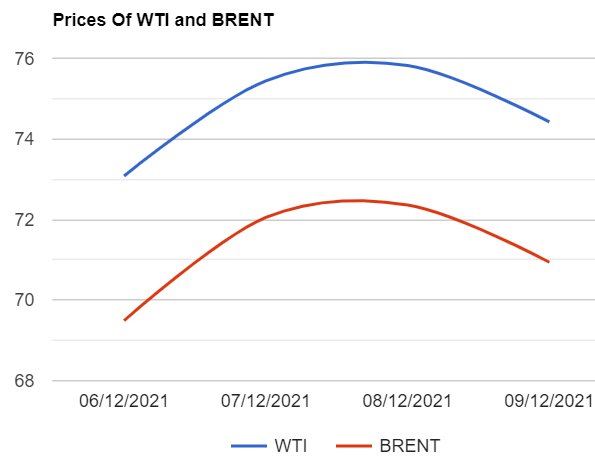

Brent oil futures prices for Feb settlement closed $1.4 or 1.85 pct lower at $74.42 a barrel on London based ICE futures Europe exchange. WTI oil Jan futures prices went down $1.42 or 1.96% to close at $70.94 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices rose 5.1 Yuan to 474.8 Yuan/bbl while MCX front month futures traded Rs.67 down to Rs.5401 a barrel during yesterday's session. Brent traded at a premium of $3.48 over WTI during the session.

The world crude oil price index curves moved down yesterday in a cautious trade amid Omicron virus fears and concerns over Chinese GDP numbers following rating downgrades to Chinese property developers that may impact oil buying appetite of the world's biggest crude consumer. On data side, U.S crude inventories were drawn by 240000 barrels last week while gasoline and distillates stocks were built up by 3.9Mbpd and 2.7Mbpd respectively. The EIA numbers sent mixed signals to the market. U.S drillers ramped up domestic production while imports numbers were up where as exports numbers went down last week. Turning to technical side, Brent calendar spread between futures contracts for February and March 2022 has slumped to a backwardation of just over 20 cents per barrel, Down from a peak of more than $1.2 at the start of November. Brent prices and calendar spreads are likely to be under pressure till the time, Market receives strong signals to bring the new wave under control with a combination of controls. Today, Asian markets are opened in bearish mood and trading in red. Both the benchmarks futures are likely to close the week higher. Rig numbers are awaited late today.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com