By Srinivas Chowdary Sunkara // petrobazaar // 10th Nov, 2022.

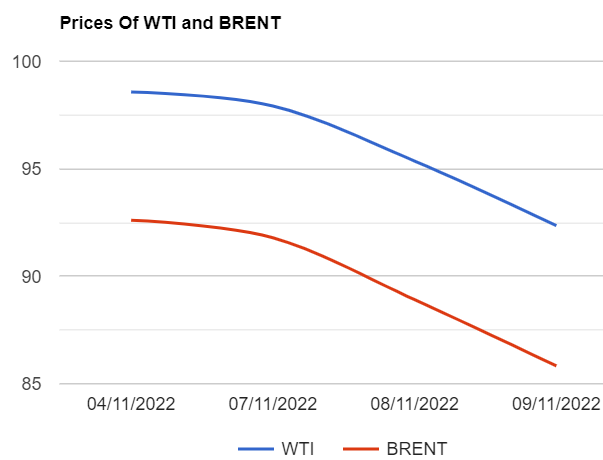

Brent oil futures prices for Jan delivery plunged $3.01 or 3.16 pct to close at $92.35 a barrel on London based ICE futures Europe exchange while WTI oil Dec futures prices tumbled $3.08 or 3.46 pct to settle at $85.83 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices fell 24.8 Yuan to 689.9Yuan/bbl where as MCX crude oil front month futures traded Rs.294 down to settle at Rs.7046 a barrel yesterday. Brent premium over WTI widened to $6.52 a barrel during the session.

The world crude oil price index curves demonstrated downside momentum. Tilted towards downside on prevailing bearish conditions across the market. Both the benchmarks posted around 6 pct in last two sessions. Industrial data showing build in U.S crude stocks, Rebound in China Covid cases, Fanned demand worries and strong dollar added to downside pressure. Turning to weekly data, EIA reported 3.9 Mbpd build in U.S crude stocks while gasoline and distillates stocks were drawn by 0.9Mbpd and 0.5Mbpd respectively during the last week. U.S domestic production numbers inflated to 200Mbpd while imports and exports numbers changed marginally. Refinery crude throughput went up with refinery utilisation increased last week.

Dollar is trading high against its peers amid U.S elections talks that is making oil more expensive. IEA chief said that Producers group decision of cut down supplies is going to push inflation up that may lead to recession. Today, Asian markets are trading steady today at the time of reporting. OPEC and IEA monthly numbers are due later this week.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com