By Srinivas Chowdary Sunkara // petrobazaar // 9th Dec, 2022.

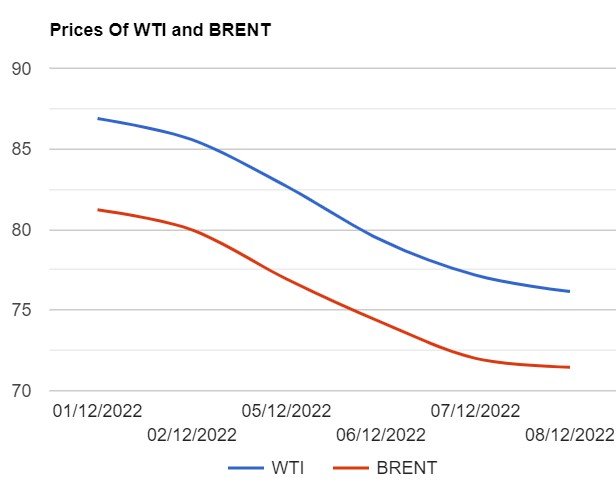

Brent oil Feb futures prices slipped further by $1.02 or 1.32 pct to settle at $76.15 a barrel on London based ICE futures Europe exchange while WTI oil futures prices for Jan delivery dropped 55 cents or 0.76 pct to $71.46 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices went up 3.2 Yuan to 518.2 Yuan/bbl where as MCX crude oil front month futures prices went Rs.91 down to Rs.5971 a barrel yesterday. Brent premium over WTI narrowed down to $4.69 a barrel during the session.

The world crude oil price index curves continued to tilt towards downside after an upside rally on closure of a major Canada -to- U.S crude pipeline, Keystone pipeline. Later on markets shrugged off the news as the analysts noted that U.S Gulf is likely to have enough inventory to handle short-term outages. Bears continued fest as traders turned back to focus on lingering worries over gloomy economic outlook that will deter demand outlook. Weekly inventory report that marked U.S crude stocks fell while product stocks were piled up that indicated demand slow down also weighed on oil complex. Both the benchmarks are trading at year's low, forfeiting all the gains after Russia's invasion of Ukraine that exacerbated the worst global energy supply crisis in decades and sent oil prices to hit all-time high. On the other hand Urals crude at Baltics this week assessed at $45/bbl, A discount of more than $30 versus dated Brent down from a steady $20 in recent weeks. Today, Asian markets are trading in green, recovering some of yesterday's losses. Both the benchmarks clung to weekly losses. Rig numbers are due later today.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com