By Srinivas Chowdary Sunkara // petrobazaar // 8th June, 2021.

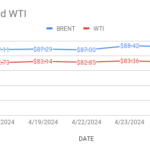

Brent oil futures prices for August delivery lost 40 cents or 0.56 pct to $71.49 a barrel on London based ICE futures Europe exchange. WTI oil July futures prices edged down 1 cent or 0.01% to close at $69.63 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices settled 2.4 Yuan down at 442.8 Yuan/bbl while MCX crude oil front month futures prices closed Rs.28 down to Rs.5046 a barrel yesterday. Brent premium over WTI narrowed down to $1.86 a barrel during the session.

The world crude oil price index curves demonstrated downside momentum yesterday after touching two year's high during the earlier sessions on expectation of OPEC+ continued restraint on supplies and positive demand outlook. Chinese low crude import numbers in May month pulled out the ground for oil prices yesterday that cautioned bulls to cap the rally. On the supply side, OPEC chief sees upbeat oil outlook on expected fall in stocks. Analysts are in the opinion that downside movement was the result of profit-booking by traders, Not a weak demand outlook since U.S and European markets are opened and India is easing lockdowns.

Technically speaking, Ref to CFTC weekly data, Portfolio managers increased their positions in petroleum last week reversing previous week's sell off. Hedge managers and other money managers purchased the equivalent of 40Mb while fund managers are responding to signs of continued output restraint and expected stock draws, Especially with U.S shale sector support. As per Kemp, The fact position-building is being led by crude rather than refined products suggests production control rather than the recovery in consumption is the primary driver of higher oil prices. Today, Asian markets opened in red, continuing yesterday's loss. It doesn't demonstrate any firm trend so far.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com