By Srinivas Chowdary Sunkara // petrobazaar // 8th April, 2021.

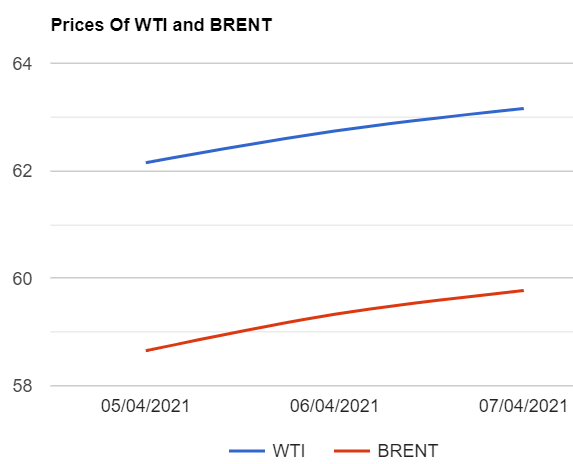

Brent oil futures prices rose 42 cents or 0.67 pct to $63.16 on London based ICE futures Europe exchange. U.S crude oil benchmark, WTI futures to be delivered in May settled 44 cents higher at $59.77 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices slipped 2.1 Yuan to 386Yuan/bbl while MCX crude oil current month futures prices closed Rs.84 higher to Rs.4449 a barrel yesterday. Brent premium over WTI narrowed down to $3.39 during the session.

The world crude oil price indices moved up yesterday on improving global economic outlook. U.S crude stock draws also lent some support to crude complex. IMF said on Tuesday that unprecedented spending to fight with Covid-19 would push global growth to 6% this year, which was not achieved for last 4 decades. U.S federal reserve also optimistic in their overall economic outlook.

Turning to weekly report, U.S crude oil inventories were drawn 3.5Mb while gasoline and distillates stocks were piled up by 4Mb and 1.5Mb respectively. Domestic production slowed down to 10.9Mbpd vs 11Mbpd last week, Despite of higher prices. Import numbers are down while exports were up while U.S refinery runs kept inching higher, up by 103kbpd w/w to 15.044mbp – highest levels since late March 2020 as per the report.

Brent spread continued to soften for the 2h21 closing in a backwardation. Traders are expecting the crude market to be moderately tight in the second half, with a slight increase in consumption, that exceeding production, causing a limited drawdown in inventories than the exceptional tightness expected a year ago as per Kemp. Asian markets are trading in red, taking back yesterday's little margins.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com