By Srinivas Chowdary Sunkara // petrobazaar // 7th August, 2019.

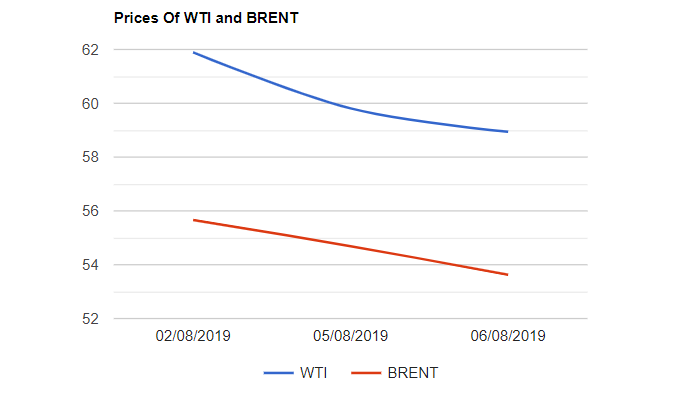

Brent oil futures prices fell 87 cents to $58.94 and WTI futures prices slipped $1.06 to $53.63 a barrel last night. Shanghai crude oil main contract futures dropped by 2.9 Yuan or 0.67% at 430.5 Yuan/barrel while MCX crude futures closed Rs.45 down at Rs.3858 yesterday. Brent premium to WTI narrowed to $5.31.

The world oil indexes extended losses after trade tariff tensions intensified worries over global economic growth. Brent oil plunged above 22% from its peak in April and plummeted more than 9% during the recent week, puts the benchmark in to 'bear territory'. Currently 'Trade Tariffs' and 'retaliatory actions' are weighing down the middle east news. Turning to weekly numbers, American Petroleum Institute (API) reported another crude inventory draw of 3.4Mb for the week ending August 1st. Consensus is on 2.848Mbpd draw. EIA will confirm the numbers later today. On the supply side, Saudi energy minister and U.S energy secretary expressed concern over the threats targeting freedom of maritime traffic in the Arabian Gulf.

Today, Asian markets opened with gap down. Oil prices are continued to be under pressure despite of expected bullish weekly numbers. Markets expected U.S – Sino trade deal, But with the fresh U.S tariff on Chinese goods and Chinese retaliation with currency depreciation will make the situation more worse which will lead to oil price collapse and the global economy will be priced for it.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com