By Srinivas Chowdary Sunkara // petrobazaar // 6th Sep, 2022.

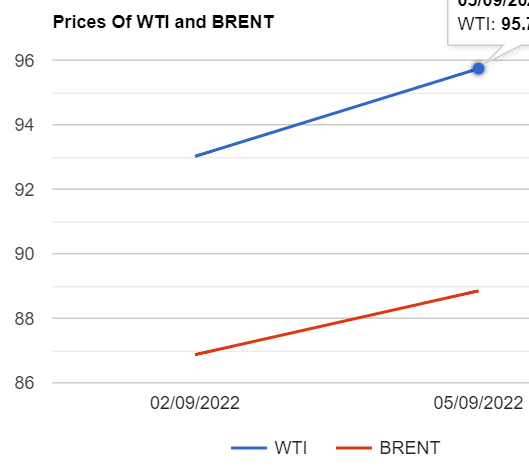

Brent oil futures for Nov delivery rose $2.72 or 2.92 pct to settle at $95.74 a barrel on London based ICE futures Europe exchange while WTI oil Oct futures prices went up $1.98 or 2.28% to close at $88.85 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices climbed 8.5 Yuan or 1.22 pct to 703.9 Yuan/bbl where as MCX crude oil front month futures prices mounted up to Rs.7123 a barrel yesterday. Brent premium over WTI widened to $6.89 a barrel during the session.

The world crude oil price index curves moved up yesterday after OPEC+ agreed to cut 100000 bpd to bolster prices. Both the benchmark prices tumbled during last three months from multi-year highs hit in March, Pressured by interest rates hikes, Recession worries and Covid restrictions in China. Analysts are in the opinion that OPEC+ sent signal to market that the group is serious about cuts to support oil prices though 100k is not a serious number and it may not impact physical markets since it is 0.1% of global demand. KSA fanned signals of production cuts last month. It is clear that OPEC+ do not want prices below $90 Brent, Closer to $100 is more like it. OPEC's price aspirations always moves higher when the market allows. Asian markets opened in green today, Adding to yesterday's gains. API numbers followed by EIA numbers are awaited this week.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com