By Srinivas Chowdary Sunkara // petrobazaar // 5th Nov, 2022.

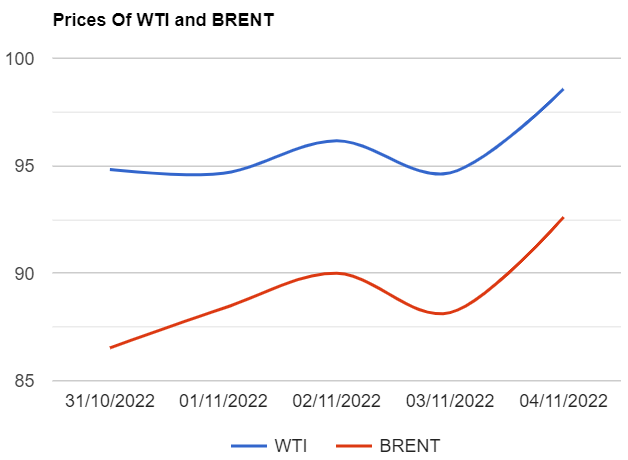

Brent oil futures for Jan delivery rose $3.9 or 4.12 pct to $98.57 a barrel on London based ICE futures Europe exchange while WTI oil Dec futures prices surged $4.44 or 5.04 pct to settle at $92.61 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices rose 8.7 Yuan to 710.5 Yuan/bbl where as MCX crude oil front month future traded Rs.204 or 2.78 pct higher to settle at $7545 a barrel yesterday. Brent premium over WTI slipped to $5.96 a barrel during the session.

The world crude oil price index curves moved yesterday after posting loss in the previous session. Both the benchmarks traded up as the market shifted focus from recession fears to tightening supplies. Looming EU ban on Russian oil coupled with slid in U.S inventories and possibility of China easing some COVID restrictions supported oil complex. On the technicals side, Money managers increased net-length in Brent oil futures and options in the week ending Nov 1. Long-only options and short-only options are rose as per ICE data. Analysts are in the opinion that $100 mark is not too far considering the compounding bullish sentiment across the market buoyed up by supply tightening talks and low inventories across the market. Turning to weekly rig data, US drillers withdrew 9 oil rig numbers to 596 during the last week. Both the benchmarks logged in weekly gains on Friday.

Good day and happy week end to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com