By Srinivas Chowdary Sunkara // petrobazaar // 5th Nov 2019.

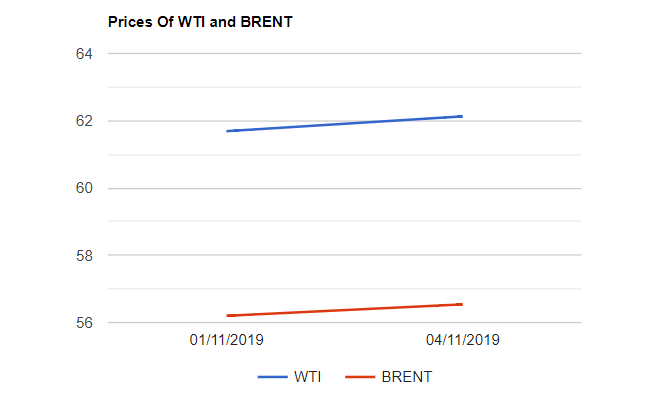

Brent oil futures prices for January settlement rose 44 cents to $62.13 and WTI oil futures prices to be delivered in Dec ticked up 34 cents to $56.54 a barrel last night. In Shanghai, Crude oil main contract futures closed 5.8 Yuan or 1.31% up at 450.2 Yuan/barrel while MCX crude oil futures settled Rs.112 up at Rs.4050 yesterday. Brent traded at a premium of $5.59 to WTI.

The world crude oil bench mark price curve continued to move up yesterday after registering around $2 gains on late week, notched a steep drop last week. The optimism surrounded by a progress in U.S-China trade talks, fed rate cut last week and better than expected U.S job growth, Expected to boost oil demand, propelled oil prices. Weak dollar also propped up oil prices while hedge funds started rebuilding long positions in crude and fuels. A preliminary poll ahead of weekly numbers showed a forecast of build in U.S crude stocks tempered gains. API weekly numbers are due later today.

Today morning, Oil futures prices opened flat during Asian hours and it does not indicate any firm trend so far. Analysts across the market warns on the gloomy outlook of oil price in 2020 based on the existing fundamentals in the market. Weekly numbers may spur some volatility today. Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com