By Srinivas Chowdary Sunkara // petrobazaar // 5th August, 2019.

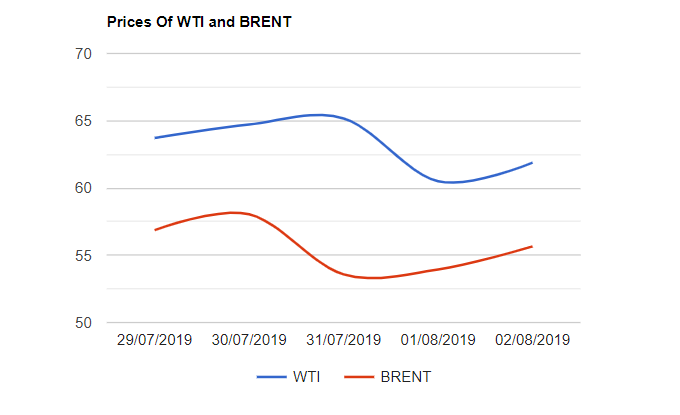

Brent Oil prices for October delivery rose $1.39 to $61.89 and WTI futures to be delivered in Sep closed $1.71 up at $55.66 a barrel on Friday. Shanghai crude oil main contract futures dropped by 16.2 Yuan or 3.64% at 428.4 Yuan/barrel while MCX crude futures settled Rs.101 up at Rs.3891 at the end of last week. Brent traded at a premium of $6.23 to WTI.

The world crude oil benchmark indexes rebounded on Friday and closed lower for the week after a massive selloff during the week following the Trump surprised tariff announcement on Chinese goods. It seems that the markets overreacted and prices are expected to back slightly below where it was prior to news during this week. Turning to rig numbers, U.S drillers took out another 6 nos of oil rigs, reaching to 770. On the supply side, OPEC's spare capacity has been rising because of the production cuts aimed at trimming over supply and bolstering oil prices. Iran's oil exports plunged to 100,000 bpd in July while Libya's oil production dragged down by another outage at Sharara oil field. Demand outlook continued to be moderated and EIA downgraded its oil demand forecast for the year 2019 from 2Mbpd to 1.1Mbpd. Oil markets opened in green during the Asian hours today. I have not found any strong trigger to move either ways today.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com