By Srinivas Chowdary Sunkara // petrobazaar // 5th February, 2021

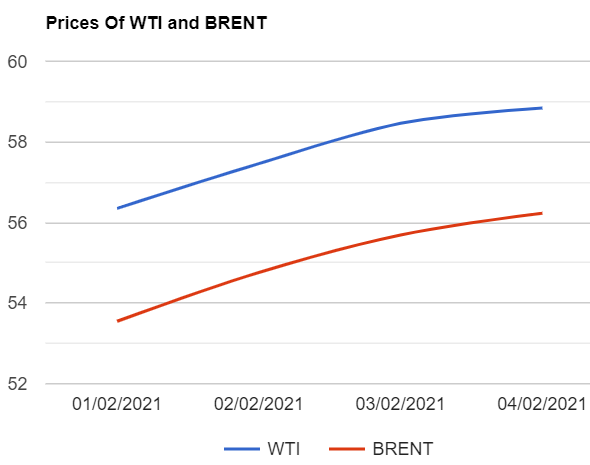

Brent oil futures for April settlement rose 38 cents or 0.65% to $58.84 a barrel on London based ICE futures Europe exchange. WTI Oil futures to be delivered in March climbed 54 cents or 0.97% to close at $56.23 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices went up 10.4 Yuan to settle at 362.9Yuan/bbl while MCX crude oil current month futures prices surged Rs.58 to settle at Rs.4116 a barrel yesterday. Brent premium over WTI narrowed down to $2.61 a barrel during the session.

The world crude oil price indices continued to demonstrate upside momentum on strong U.S economic data , Inventory drawings and OPEC+ decision to stick to pledged cuts while stronger U.S dollar limited the prices. U.S labour department showed a drop in Americans filing new applications for unemployment benefits last week helped to boost prices. Turning to weekly data, Baker Hughes report is due later today. On the supply side, Russia pushed for output increases to protect market share while KSA pressed to continue restricting output in the hope of pushing prices higher. Brent's six-month calender spread has swung into a backwardation of more than $2.2 per bbl from Contango of $2.5. Today, Asian markets are trading in green and it doesn't demonstrate any firm trend so far. Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com