By Srinivas Chowdary Sunkara // petrobazaar // 4th March, 2021

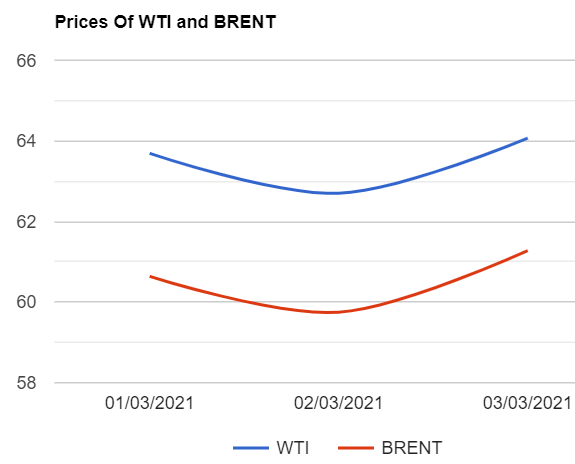

Brent oil futures for May settlement rose $1.37 or 2.19 pct to close at $64.07 a barrel on London based ICE futures Europe exchange. WTI oil futures to be delivered in April shot up $1.53 or 2.56% to settle at $61.28 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices rose 5.2 Yuan to 398.5 Yuan/bbl while MCX crude oil current month futures prices closed Rs.60 higher at Rs.4517 a barrel. Brent premium narrowed down to $2.79 a barrel over WTI during the session.

The world crude oil price index curves turned up on bullish U.S weekly stock numbers coupled with expectation of OPEC+ rolling over cuts from March to April. Vaccination news also supported oil complex. Turning to weekly numbers, EIA reported that U.S crude inventories jumped up by 21.6Mb while gasoline and distillates stocks were drawn by 13.6Mb and 9.7Mb respectively. The crude build was most on record while refining capacity fell to 56% of overall capacity, the lowest on record. On supply side, JMMC meeting ended yesterday without any recommendations. OPEC+ is scheduled to meet today for further discussion. Market is expecting group to take in more supply but all options remained open. Today, Asian markets opened in green, continuing yesterday's gains, Any outcome from group's meet will spur some volatility.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com