By Srinivas Chowdary Sunkara // petrobazaar // 4th Feb, 2021.

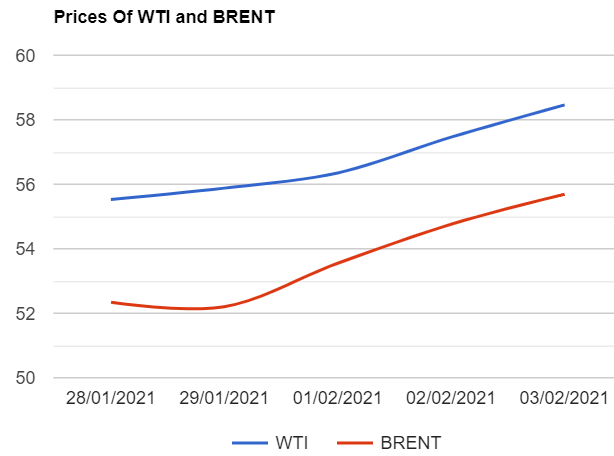

Brent oil April futures prices rose $1 or 1.74% to $58.46 on London based ICE futures Europe exchange. WTI oil futures for March delivery surged 93 cents or 1.74% to $55.69 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures soared 5.7 Yuan to 352.5 Yuan/bbl while MCX crude oil front month contract futures closed up Rs.50 at Rs.4058 a barrel yesterday. Brent premium over WTI narrowed down to $2.77 a barrel during the session.

The world crude oil price indexes demonstrated upward momentum yesterday amid positive vibes across the market. Bullish U.S stock report, OPEC compliance rate and Biden's proposed $1.9 trillion coronavirus aid plan altogether bolstered oil prices to push to highest levels in more than a year. Turning to weekly data, EIA reported 1Mbpd drawings in crude stocks. Gasoline stocks are built up by 4.5 Mbpd while distillates stocks remained unchanged. It seems refineries became active on positive demand outlook. On the supply side, JMMC reminded all the participants to remain vigilant and flexible given the uncertain market conditions. The meeting mentioned the positive demand outlook on vaccination roll out and aimed at 99% compliance. Both the benchmarks are in backwardation, where current month futures prices are higher than later on expected deficit supplies. Today, Asian markets opened in green, continuing yesterday's profits and it doesn't demonstrate any firm trend so far. Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com