By Srinivas Chowdary Sunkara // petrobazaar // 3rd August, 2021.

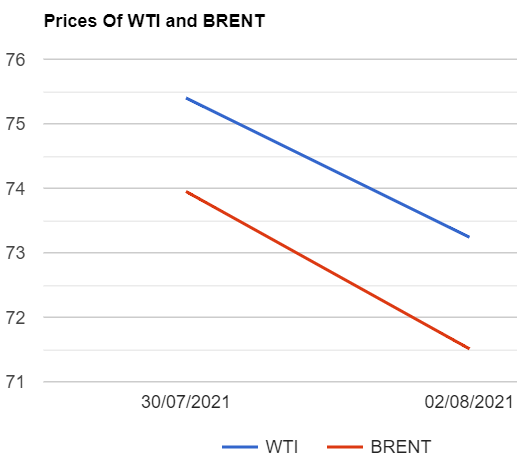

Brent oil futures prices for October settlement dropped $2.16 or 2.86% to $73.24 a barrel on London based ICE futures Europe exchange. In U.S., WTI oil Sep futures prices closed $2.44 down to $71.51 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices slipped 2.9 Yuan//bbl to 449.3 Yuan//bbl while MCX crude oil front month futures prices fell heavily by Rs.221 to close at Rs.5296 a barrel yesterday. Brent traded at a premium of $1.73 a barrel over WTI during the session.

The world benchmark crude oil price index curves demonstrated down side momentum on strong bearish sentiment buoyed by weak Chinese factory numbers. The world's second largest economy suffered from higher raw material cost, Equipment maintenance and extreme weather that weighed on growth numbers in July. On the other side, prevailing concerns are compounded by rising virus numbers and jump in oil output from producer's group. Analysts are in the opinion that oil markets fairly valued and have support from products market despite of new variant. On the data side, API estimates are awaited later today followed by EIA weekly numbers. Today, Asian markets opened in positive territory, giving back yesterday's losses. Markets are expected to recover after another big Monday's slump.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com