By Srinivas Chowdary Sunkara // petrobazaar // 3rd May, 2019.

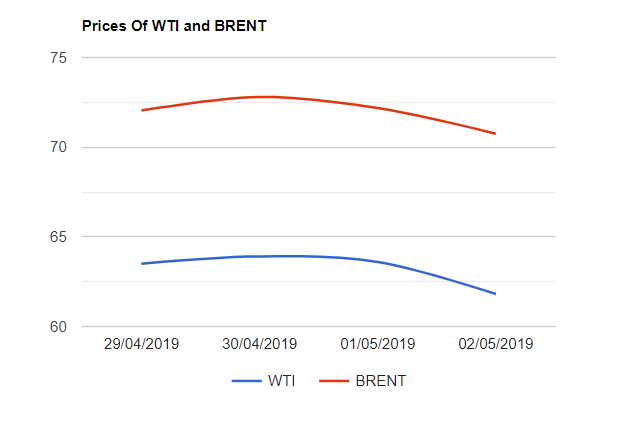

Brent prices dropped $1.43 to $70.75 and WTI prices settled $1.79 down at $61.81 a barrel last night. MCX crude futures slipped Rs.145 to settle down at Rs.4277 yesterday. The global crude markers plunged around 3% and U.S crude futures are heading towards highest weekly loss after Feb, 2019. Oil markets grappled with over supply fears as the market felt that U.S sanctions on Iran will have no immediate effect on the market. A sharp build in U.S inventories last week also pushed the market into bearish mood.

Turning to weekly report, Crude inventories were built up surprisingly by 9.4Mbpd while domestic production market up by 100Kpd at 12.3Mbpd last week as per the EIA data. Increase in imports, decrease in refinery utilization and U.S refineries entering into spring maintenance period could be the main reasons behind the piling up of crude stocks during the last week. Today, Asian markets are opened in red. Have a good day and happy week end to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com