By Srinivas Chowdary Sunkara // petrobazaar // 2nd Oct 2020.

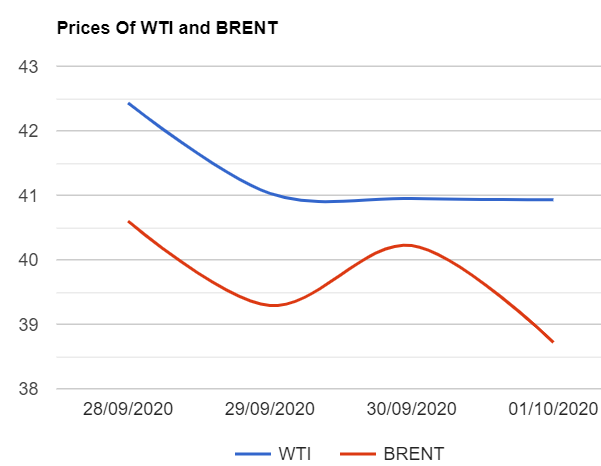

Brent oil futures prices for Nov delivery edged down 2 cents or 0.05% to $40.92 on London based ICE Futures Europe exchange and WTI oil Nov futures prices dived $1.5 or 3.73% to close at $38.72 a barrel on NYMEX last night. In India, MCX Crude October futures prices correctly sharply by Rs.116 or 3.95% to settle down at Rs.2821 a barrel yesterday. Brent premium over WTI widened to $2.21 a barrel during the session.

The world crude oil price index curves moved sharply down yesterday though Asian markets opened in green, followed by sharp sell off, Buoyed by bearish signals across the market. Although, Optimistic weekly crude stock numbers supported to certain extent, Increase in crude supply numbers and product stock numbers concerned the market amid gloomy demand outlook caused by resurgence in infection numbers, focused on Europe. On the supply side, Increase in Libya's barrels along with other producers submitting production plan to secretariat kept weigh on oil complex. Baker Hughes reported that U.S oil rig count gains 17 to 234 that might add to current bearish signs.I agree with Dr.Gary's comment that products getting better, setting stage for higher ref runs later and crude stock decline.

Today, Asian markets opened in red, continuing yesterday's session losses. Both benchmarks are set to log in weekly loss. I advise traders to be cautious over open positions and trade with strict stop loss.

Good day to all and happy week end.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com