By Srinivas Chowdary Sunkara // petrobazaar // 2nd June, 2022.

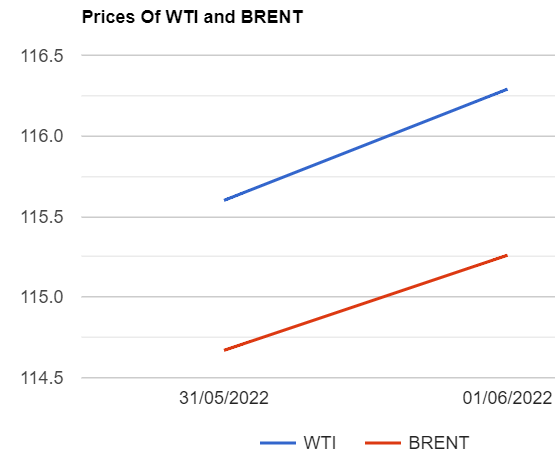

Brent oil August futures prices rose 69 cents or 0.6 pct to close at $116.29 a barrel on London based ICE futures Europe exchange while U.S crude oil July futures prices went up 59 cents or 0.51% to settle at $115.26 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices slid 22.3 Yuan to 734.9 Yuan/bbl where as MCX crude oil front month futures traded Rs.95 higher at Rs.8986 a barrel yesterday. Brent traded at a premium of $1.03 over WTI during the session.

The world crude oil price index curves moved high yesterday after EU agreed in principle to ban Russian oil on phase wise that signaled tightening of oil. China ended covid-19 lockdown in Shanghai, Which would bolster demand also supported prevailed positive sentiment. Turning to weekly data, EIA reported that U.S crude and gasoline stocks were drawn by 1 Mbpd and 0.5 Mbpd respectively while distillates stocks were built up by 1.7Mbpd during the last week. There was no change in U.S domestic production. Slippage in Imports numbers along with jump in export numbers might have caused stock draws. Cushing stocks were drawn last week. OPEC+ group is scheduled to meet today to discuss policy. As per sources, The members did not discuss the idea of suspending Russia from the current oil supply deal. Today, Asian markets opened in red at the time of reporting.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com