By Srinivas Chowdary Sunkara // Petrobazaar // 1st Feb, 2022.

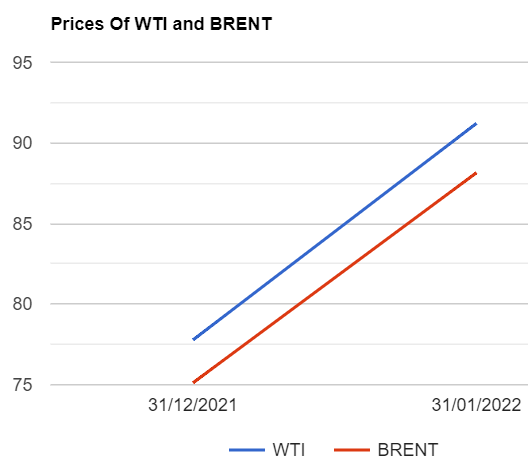

Brent oil futures for April delivery traded 74 cents higher or 0.8% to settle at $89.26 a barrel on London based ICE futures Europe exchange. The front-month contract that expired, Rose $1.18 or 1.3 Pct to finish at $91.21 a barrel yesterday. WTI oil March futures prices climbed $1.33 or 1.53% to settle at $88.15 a barrel on NYMEX last night. In Shanghai, Crude oil main contract futures prices remained at 534.5Yuan/bbl while MCX crude oil front month futures prices settled Rs.22 higher at Rs.6571 a barrel yesterday. WTI traded at a discount of $3.06 a barrel over Brent during the session.

The world crude oil price index curves continued to hover at multi year's high levels amid expected supply shortage and escalating political tensions in Eastern Europe and the Middle East. Both the benchmarks recorded biggest monthly gains of 17% since Feb, 2021 with sixth straight weekly gains ahead of OPEC+ meet. Markets are widely expecting that the group will stick to the existing policy of increasing 400000 barrel per month. Members are not able to meet the target. On the technical side, Portfolio managers took some profit last week while Hedge funds and money managers opted to sell off. Investors are still overwhelmingly bullish towards oil with a net long position of 743 Mb across all six contracts and long positions outnumbering shorts by 6:1. Six month backwardation in both Brent and WTI futures are among the most severe for a third of a century, Consistent with traders expecting low and falling inventories. Today, Asian markets are opened in green, Adding to yesterday's gains. I expect bulls will continue to celebrate this week.

Good day to all.

Disclaimer: Views and opinions expressed here are personal. This commentary is for information purposes only and not an offer or a solicitation to sell or buy any physical commodities or financial instruments. The views and analysis are based on reliable public information available at the time of writing. This report and its content cannot be copied, redistributed or reproduced in part or whole without the prior written permission of petrobazaar.com