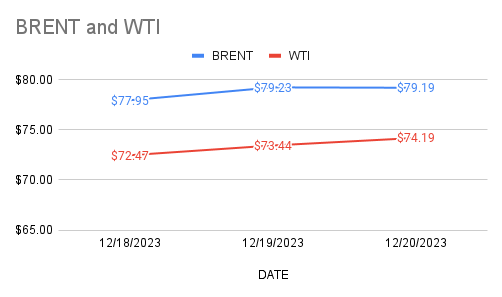

crude brent oil futures for feb delivery moving steady at $79.19 while wti oil futures prices for Jan delivery rising $1.72 or 2.3% to $74.19 a barrel on Wednesday morning during asian hours at the time of reporting. U.S crude Jan futures are set to expire today. Both the benchmarks closed up around 2% in the previous session.

crude benchmark indices are demonstrating upside momentum on bullish sentiment buoyed up by geo-political tensions via red sea. Traders eyed on Houthi attacks on ships in the red sea that jitters political tensions. Analysts are in the opinion that only 12% of world shipping pass through the Suez Canal that limits the impact on commerce. On the weekly numbers, API estimated that U.S crude and product stocks rose during the last week. EIA will confirm numbers later today. Consensus is on draws. The U.S bought 2.1 Mb of crude oil to pump replenish the SPR and The U.S is producing more oil than any country in history that will lead to strong non-opec supply, can cater growing demand in the world.

EIA numbers along with geo-political news may spur some volatility in the oil markets. I expect oil markets move steadily during this week.