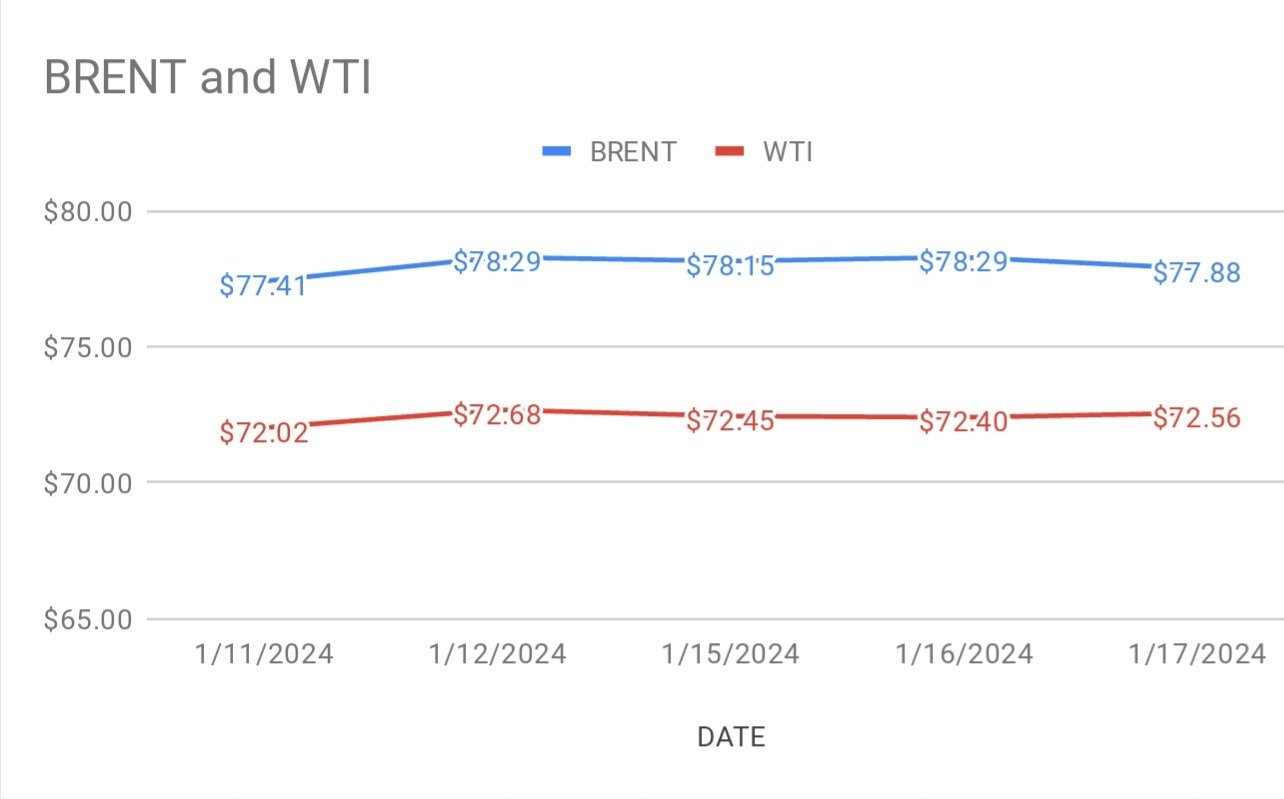

crude brent March Futures prices unchanged at $77.95 a barrel while WTI Futures for Feb delivery moving flat at $72.8 a barrel on Wednesday morning during Asian hours at the time of reporting. Both the benchmarks closed flat yesterday. Wti traded at a discount of $5.32 over brent during yesterday’s session.

crude benchmark price index curves are moving straight. Production disruptions in U.S due to severe cold weather offset Chinese bearish economic growth numbers. Market watchers continue to look at deveopments in red sea waters dispute.

Turning to monthly data, OPEC monthly oil report early predictions for 2025 surprised the market. OPEC reiterated it’s stand on demand growth in 2024 at 2.25 mbpd while 2025 will see at 1.85mbpd respectively. The report also said that Asian countries are going to be major consumers of oil. Analysts see OPEC numbers contradict IEA numbers. IEA reported that demand will halve in 2024 due to Gloomy economic outlook in major economies. Putting some light on weekly numbers, API reported that U.S crude stocks were drawn by 480000 barrels. EIA will confirm numbers later today.