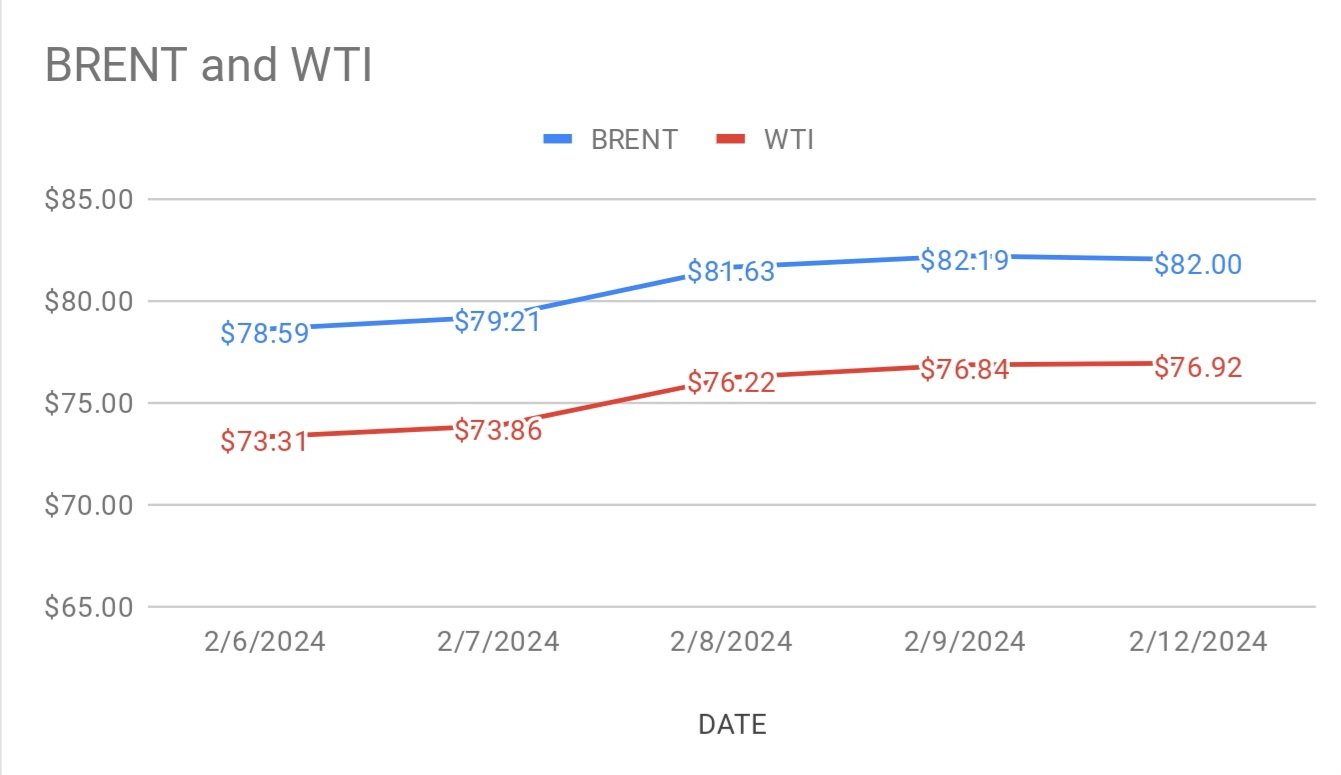

Brent Futures for April delivery are trading at $82.05 a barrel while wti march futures are moving at $77.05 a barrel on Tuesday morning during Asian trading hours. Both the benchmarks changed a little yesterday. Brent traded at a premium of $5.08 over wti during the session.

crude price curves are slating flat after logged in 6 percent gains last week. Traders are moving cautiously amid uncertainty over the pace of expected increase in fed interest rates and it’s impact on demand outlook. Expectation of hike in interest rates outweighed prevailing middle east tensions that kept floor to oil prices. Putting some light on technicals, portfolio managers left wti market and reduced positions in majority of petroleum Futures and options during the week ending Feb 6th. Fund managers cut down crude positions on expectation of piling up stocks. API numbers are awaited later today. Consensus is on stock build. U.S inflation data is due today. Monthly numbers are awaited this week. I expect Data may spur some Volatility in crude markets this week.