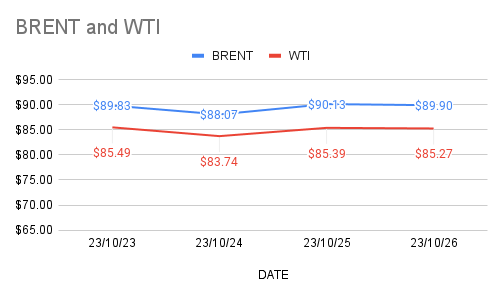

Brent oil futures prices for Dec delivery inched down 18 cents to $89.95 a barrel while WTI oil Dec futures prices edged down 9 cents to $85.3 a barrel on Thursday morning during Asian hours. Both the benchmarks settled around 2 % high yesterday. Brent premium over WTI widened to $4.74 a barrel during the session.

The crude indicators are moving down today, Clawing back some of yesterday’s gains on macro economic concerns. Piling up U.S crude and product stocks compounded prevailing demand fears that keep crude markets in check. Europe weak manufacturing numbers and strong dollar keep weigh on oil complex. Oil markets are deriving some support from retreating China’s activities and escalation of Middle east tensions. U.S crude futures calender spreads collapsed over the last month. The recent expired Nov-Dec spread closed in a backwardation of just 84 cents per barrel as against $2.38 on Sep 27th. The most active Dec-Jan spread has come to a backwardation of 77 cents on Oct 24th from $2 on Sep 20th that signal squeeze on crude inventories.

crude markets are in limbo. Investors are grappled with demand concerns that spilled over from weak numbers from Euro zone. crude markets seems to be unsteady during the week.