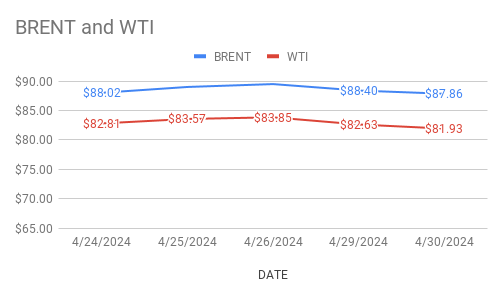

Crude Brent oil July futures are trading at $87.88 a barrel with no change while WTI oil prices for June delivery slid above 1 pct to $80.82 a barrel today at the time of reporting. Both the futures fell around 0.5 pct for third session yesterday. Brent traded at a premium of $5.93 over WTI a barrel during yesterday’s session.

crude benchmark futures curves are moving on straight line after moving down for last three sessions. Bearish weekly numbers keep weigh on oil complex. Turing to weekly reports, API reported that U.S crude stocks swelled last week by 4.906Mb while product stocks fell. As per the report, U.S gasoline stocks fell by 1.483Mbpd while distillates stocks sank by 2.187Mbpd respectively during the last week. Official data from U.S govt is due later today. On the supply side, Expectation of ceasefire agreement between Israel and Hamas could be in sight following a renewed push by Egypt to revive stalled negotiations between two that pushed down oil prices. Expected fall in production from OPEC group could lent support to oil prices while U.S production numbers dent oil prices. Markets eye on EIA report. Any swelling in U.S stocks could spur some volatility in the market during the week.