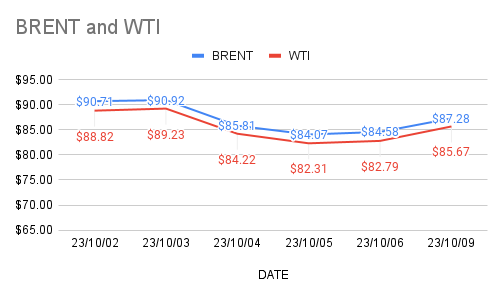

Brent oil futures for Dec delivery rose $1.9 or 2.246% to $86.48 a barrel while WTI futures prices for Nov delivery soared $2.26 or 2.73% to $85.05 a barrel during Asian hours on Monday morning on Political uncertainty across the Middle East that may further tighten supplies. Both the benchmarks closed up with 0.5% change on Friday, Logged in around 11% weekly loss. Brent traded at a premium of $1.79 a barrel during Friday session.

Both the benchmarks traded down last week to March 23 lowest levels on fears of interest rates hikes. Crude markets rebounded after Hamas launched the largest military assault on Israel in decades that triggered a wave of retaliatory Israeli air strikes on Gaza that also killed more than 400 people. Putting torch on technicals, Fund managers reduced their net length in both Brent and WTI futures and options till Oct 3rd. Longs left the markets but shorts reduced the numbers on profit taking amid cautious trading.

Crude markets more vulnerable to changing dynamics of ongoing political crisis in Middle east. The risk premium on oil is rising due to prospect of a wider conflagration that could spread to nearby major oil producing nations such as Iran and KSA.

/