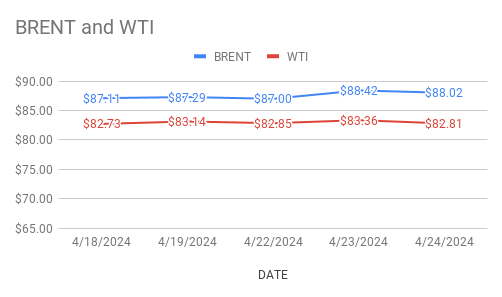

Crude Brent oil June futures prices rose 19cents or 0.216 pct to $88.21 a barrel while WTI oil June futures are trading 16 cents or 0.193 pct up to $82.97 a barrel at the time of reporting. Both the benchmarks futures traded down yesterday. Brent premium over WTI widened to $5.21 a barrel during yesterday’s session.

crude benchmark price index curves slightly moved up today amid bullish mood ignited by bullish weekly numbers. Trouncing analysts expectations, U.S crude stocks piled up by 6.4Mbpd while gasoline stocks are dipped by 0.6Mbpd where as distillates stocks went up by 1.6Mbpd respectively. EIA report did not paint any gloomy picture on demand outlook. Markets are more worried on contracted economic activity in the world’s largest oil consumer. Analysts see that current price trend after touching $90 mark is due to week fundamentals that outweighed geo-political tensions in the markets. Middle east tensions seems to be cooled off temporarily. U.S gross domestic product report is awaited. Technically speaking, profit booking is very likely at the end of the week.