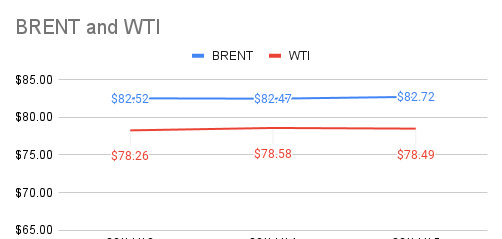

Brent oil futures prices for Jan delivery inched up 28 cents or 0.34% to $82.75 a barrel while WTI oil Dec futures prices edged up 23 cents or 0.3% to $78.49 a barrel on Wednesday morning during Asian hours at the time of reporting. Both the benchmarks closed largely unchanged yesterday. Brent premium over WTI narrowed down to $4.21 a barrel during yesterday’s session.

The world crude oil benchmark indices tilted upwards for last four sessions after monthly reports painted strong demand outlook. Crude markets whipsawed last week as demand fears spilled over across the market. Turning to weekly numbers, API estimated a build in U.S crude stocks during last week. EIA confirmation is awaited for two weeks since no data released last week due to systems maintenance. Putting some light on technicals, Long positions widened in both brent and crude futures contracts as reported by ICE and CFTC.

Positive demand outlook reported by monthly reports, Weak dollar and escalation of rift in Middle east are the bullish factors seen in the market. A flurry of economic data like Japanese GDP, Chinese retail sales, Industrial output, Investment and unemployment numbers in Oct are awaited during the week. Strong numbers may spur volatility this week.