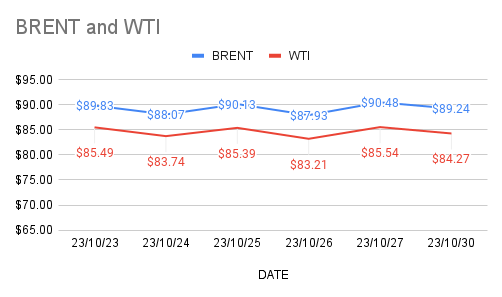

Brent oil futures for Dec delivery trading $1.24 or 1.37% down at $89.24 a barrel while most active WTI dec futures prices moving $1.31 or 1.531% a barrel on Monday morning during Asia trading hours. Both the benchmarks clocked 3% high on Friday, logged in weekly loss after two weekly gains. Brent premium over WTI widened to $5 a barrel during Friday’s session.

Crude indices moving wizardly on lack of fundamental clues. The weekend sharp swing on war premium could not sustain on Monday as the investors are moving cautiously. U.S fed meeting outcome, China’s manufacturing PMI , U.S job data are in focus during the week. Markets are closely observing the factor of ‘escalation of Middle-east political turmoil – demand outlook’. crude complex is deriving support from the prevailing war fears across the market.

Turning to technicals, Portfolio managers reduced their net length by 10766 contracts to 216696 in Brent. crude oil futures and options for the week ending Oct 24th. Very marginal increase of Longs and shorts positions reported. Investors reduced net length in WTI by 6603 contracts to 214269 with a negligible build in longs and shorts during the period.