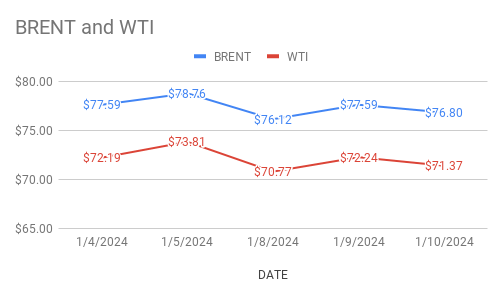

Crude brent futures prices for March delivery changed a little at $77.01 a barrel while WTI futures are trading at $71.52 a barrel on Thursday morning during Asian morning trading hours. Both the benchmarks lost around 1 per cent yesterday. Brent premium over WTI widened to $5.43 a barrel during the session.

Crude benchmark curves tilted towards bearish zone yesterday after moved up in the early session. More than expected build in U.S crude and product stocks clouded the market with bearish sentiment. EIA reported that U.S crude stocks piled up 1.3Mbpd against the analysts expectation of 700,000 barrels drop. Gasoline stocks were jumped by 8Mbpd along with distillates stocks by 6.5Mbpd during the last week as per the report. Escalation of political turmoil in the middle east factor remains supportive to oil complex. Traders are cautiously rebalancing bleak demand outlook and geo-political factors. EU facing recession heat is another bearish factor that is weighing on crude markets.

crude prices are very likely to be remain rangebound during this week. Bulls return to market is keeping floor to oil prices. Monthly reports are awaited. Rig numbers are due this week.