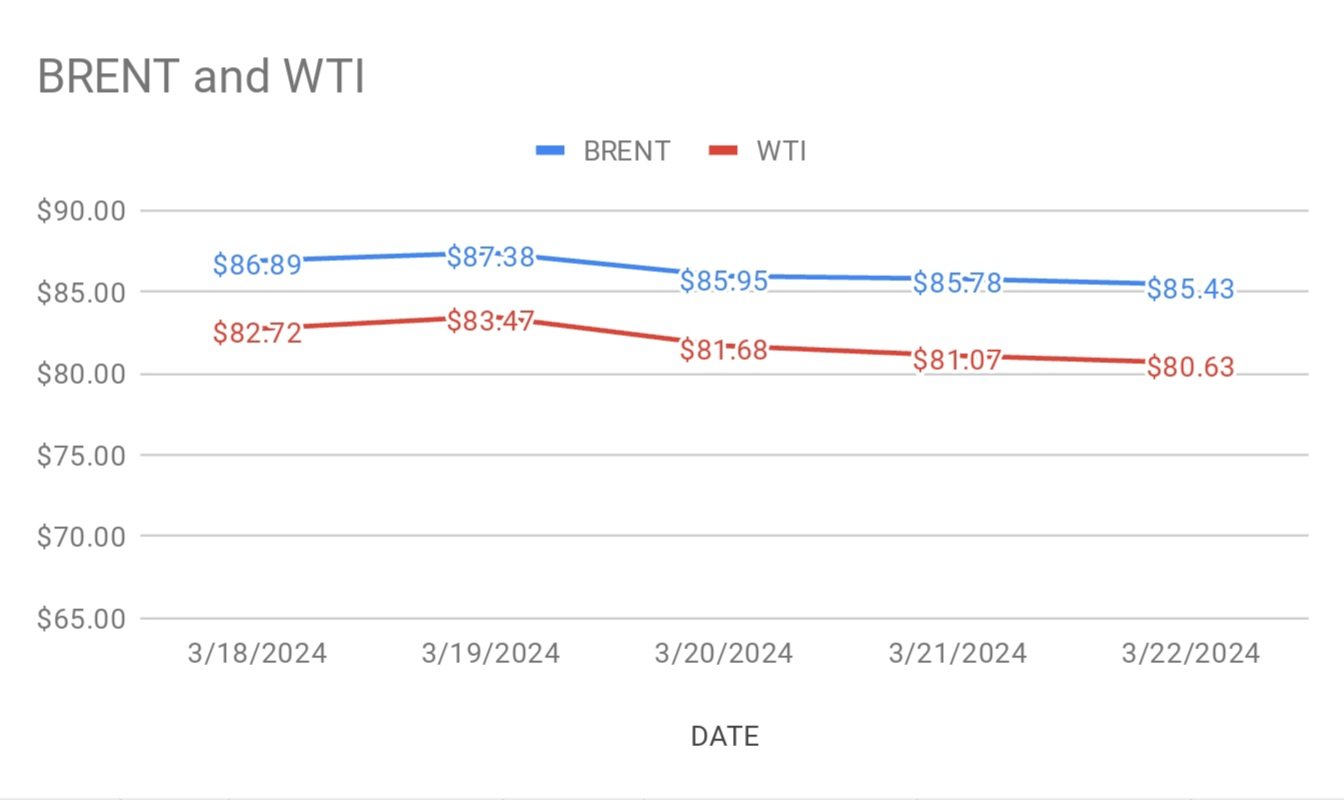

crude brent oil futures prices for April delivery inched up 28 cents to $85.71 a barrel while WTI oil April futures prices edged up 31 cents to $80.94 a barrel during Asian hours today. Both the benchmarks logged in weekly loss below 1 percent last week. Brent traded at a premium of $4.36 a barrel over WTI during Friday session.

crude benchmark indices turned up today after falling for last three sessions. On the fundamentals side, Escalation of prevailing geo-political tensions compounded with ongoing attacks between Russia and Ukraine keep supporting oil complex. Turning to supply side, due to disruptions in Russia’s refineries added pressure on fuels markets that led to rising demand for available crude cargoes which we call it as widening backwardation. Putting some light on weekly data, Falling U.S oil rigs last week as reported by Baker Hughes also lent some support to crude markets. On the financial markets front, Strong dollar kept lid on oil prices last week. On the Technicals side, Portfolio managers added positions to six most important petroleum oils and futures contracts. Longs entered into both brent and wti markets while shorts settled in brent while keeping in wti. Weekly numbers and monthly indexes are awaited this week.