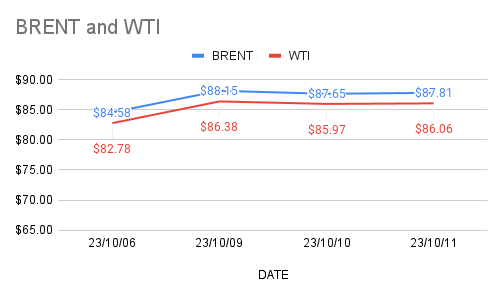

Brent oil futures for Dec delivery inched up 20 cents or 0.228% to $87.85 a barrel while WTI Nov futures prices edged 19 cents or 0.221% up on Wednesday morning during Asian hours. The world’s crude benchmarks futures closed 0.5% down yesterday after a bounce back on Monday followed by spike on Tuesday on political turmoil in Middle east fanned supply concerns. Brent premium over WTI narrowed down to $1.68 a barrel during yesterday’s session

As per analysts, Middle east supply concerns seems to be getting faded in the market though political risks continue to support oil prices not to fell down. On the supply side, Venezuela and U.S have progressed in talks that could provide sanctions relief to Caracas by allowing at least one additional foreign oil firm to take Venezuelan crude oil under some conditions. putting torch on data, Monthly numbers are due this week. API numbers are awaited later today followed by EIA confirmations.

Oil traders seems to be very cautious in taking positions. I feel crude markets are remain to walk a tight rope this week due to missing fundamental clues. Data may spur some volatility.