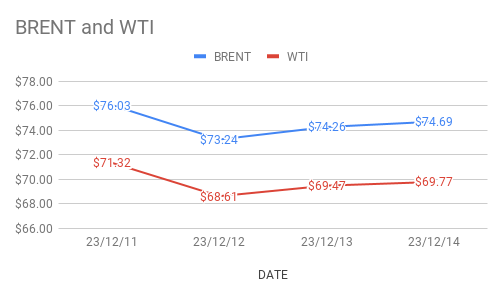

crude Brent oil Feb futures prices up 61 cents to $74.87 a barrel while WTI futures for Jan delivery rose 50 cents to $69.96 a barrel on Thursday morning during Asian hours. Both the benchmarks closed above 1% up in the previous session. Brent premium over WTI widened to $4.79 a barrel during the session.

crude benchmark futures curves moved up today, Continuing yesterday’s session upside momentum. More than expected drawings in U.S crude stocks pushed oil prices up. As per EIA data, U.S crude stocks went down 4.3Mbpd while gasoline and distillates stocks are marginally up by 0.4Mbpd and 1.5Mbpd respectively during the last week. Analysts see product numbers as bearish factor that signaled slowing demand. Crude oil prices slumped around 10% after OPEC+ announced deeper cuts on Nov.30th. Technically speaking, Investors are following cautious approach. It is predicted that oil investors to usher in 2023 due to expected gloomy economic outlook , Gnawing concerns about over supply and simmering middle east tension.

Crude markets set to close with another weekly loss. Rig numbers are awaited. IEA numbers, OPEC monthly oil report and CFTC, ICE data awaited.