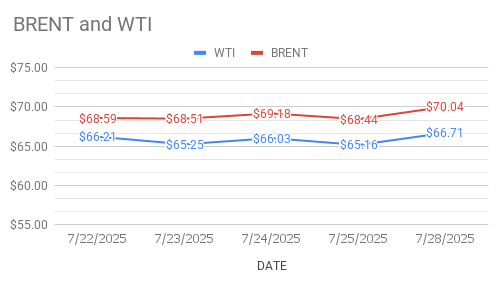

crude oil price as on 29th July, 2025

crude oil price trends: Brent oil futures prices for Sep delivery rose 21 cents or 0.3 pct to $70.25 a barrel on London based ICE Futures Europe exchange. WTI oil Sep futures prices edged up 4 cents or 0.06 pct to $66.75 a barrel on NYMEX on Tuesday morning during Asian hours. Both the benchmarks closed up above 2 pct last night. Brent – WTI spread widened to $3.33 a barrel during the session.

Fundamental Analysis: Oil prices are propping up by fundamental factors such as U.S – Euro trade deal, Trump new deadline to Russia – Ukraine and Fears of disruption in Russian oil supplies. The U.S – Europe trade agreement sidestepped a full blow trade war between two major allies that would have rippled across nearly a third of global trade and pintched the fuel oil demand outlook. Top economic officials from Both U.S and China in meeting at Stockholm for ongoing discussions that indicated possibility of extending trade truce between both the giants.

Brent Oil Technical Analysis: Brent technical indicators signalling strong bullish intraday bias supported with strong trend. RSI at 62 and MACD indicators are signalling strong buying. all moving averages align bullish except a slight overbought caution.

WTI OIL Technical Analysis: RSI at 60.25 sending buying call, MACD (0.26) is positive for buying, Stochastic and ADX all in buy zones. Momentum indicators signal a bullish intraday bias supported by a strong trend looking for potential continuation if prices held above 66.80 support.

MCX Crude oil Technical Analysis: Trading view shows a over all ‘buy’ technical recommondation, But oscillators rated neutral suggesting caution. If price holds above Rs.5748, Look for long opportunities with conservative targets. If breakout occurs below Rs.5653 downtrend bias suggested. watch sudden volume build ups or sharp price moves and fundamentals.