Crude Oil Price Today as on 26th May, 2025.

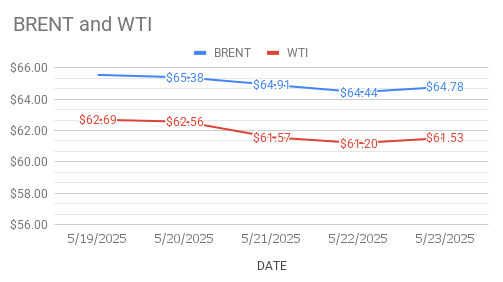

Crude oil Brent July futures prices inched up 14 cents or .2 pct to $64.35 a barrel on London based ICE Futures Europe exchange while WTI oil futures prices for July delivery edged up 15 cents or 0.24 pct to $61.68 a barrel on NYMEX on Monday morning during Asian hours. Both the benchmarks closed Friday trading in thin margins, logged in weekly loss. Brent spread over WTI widened to $3.25 a barrel during Friday session.

Fundamental Analysis: Crude oil benchmark price index curves turned up today after prolonged downside momentum for last couple of sessions. Trump extension of trade talks deadline with the EU is in headlines. Prospectus of OPEC+ group opening spigots to boost production is the factor that is keeping cap on oil prices.

Technical Analysis: Referring to last week’s WTI market positioning data, Longs exit with rising short positions along with decreasing net length indicated bearish sentiment among money managers. I anticipate short term down trend for WTI due to bearish divergence. On the contrary, boosting both Brent long and short positions may spur volatility amid renewed bullish momentum.

WTI market Predictive analytics: Mild bearish pressure and potential consolidation possible if fundamentals doesn’t support.

Brent Market predictive analytics: Bullish momentum could lift Brent, if macro data or geo-political factors are supportive. Sharp move in either direction is possible due to increased open interest on both sides.