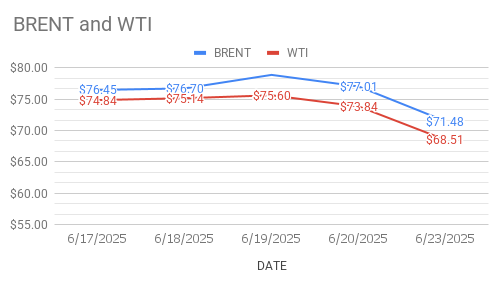

crude oil price Today as on 24th June, 2025

crude oil price trends: Brent oil futures for August delivery opened $3.6 or 5 pct down at $67.88 a barrel on London based ICE Futures Europe exchange while WTI oil August futures opened further $3.48 or 5 pct down to $65.03 a barrel on NYMEX during early Asian hours on Tuesday Morning. Both the benchmarks crashed around 7 pct during Monday trading.

Fundamental Analysis: Iran unclosing ‘Straight of Hormuz’ is the only positive factor that cooled off the oil prices. Traders are guaged Iran’s retaliation moves over U.S attacks on its Nuclear facilities. Brent rose almost 6 pct on Investor’s worries over disruption of oil exports for ME region. It was evident that oil flows are not primarly targetted as of now, it is only a military retaliation. On the other words, oil markets are downplaying the ‘geo-political risk’ factor as of now. U.S weekly stock reports are due later today followed by eia confirmations.

Technical Analysis: Both the benchmarks price curves turned down after demonstrating upside momentum on Monday. Brent RSI near oversold territory. MACD line below zero indicating bearish momentum. Brent shows signs of near term bottoming. WTI will face further downward pressure. RSI indicator signalled strongly oversold. EMA indicated bearish pressure. Any further short covering really could push prices further down.