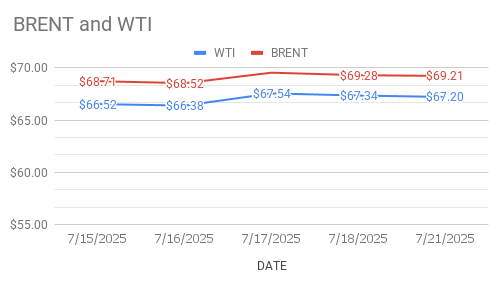

crude oil price Today as on 22nd July, 2025

crude oil price trends: Brent oil futures for Sep delivery inched down 13 cents or 0.188 pct to $69.08 a barrel on London based ICE Futures Europe exchange while WTI oil August futures dipped 13cents or .197 pct to $65.82 a barrel on NYMEX on Tuesday Morning duirng Asian hours. Both the benchmarks closed down last night.

Fundamental Analysis: EU sanctions on Russian crude weighed on oil complex while expected diesel shortages pared the losses. Since EU targetted Russian crude and products supplies our of Russian crude process from third countries have minimal affect on oil prices yesterday. Tariffs talks continue to persist in the market. Iran nuclear talks fanned fears across. Speculators data sent mixed signals as longs left WTI markets while widened positions in Brent markets. Apart no more Fundamental cues to trigger oil prices in either direction. Weekly inventory data due later today followed by eia confirmation that may provide some clues.

Brent Oil Technical Analysis: Brent price curve flattened, consolidating with no volatility. RSI indicator approaching over bought zone, MACD line slightly above signal, indicatoring bullish sentiment. Histogram turning positive with minor strength building. volatility and volume are low. Ideal strategy is range trading with tight SL.

WTI OIL Technical Analysis: WTI price indicator is flat and consolidatating after a dip. RSI in neutral zone, neither overbought nor over sold. Histogram flat. MACD still too flat for strong momentum.